The Bank of Ghana has defended its $120million auction for the first-quarter of this year to control the depreciation of the cedi.

The central bank maintained that the move forms part of measures to protect the forex market from any shocks due to the volatility of the market.

Official figures from the Bank of Ghana show that the cedi had depreciated by 1.3 per cent to the dollar as of January 19, 2017. The figure, however, represents a sharp decline from the 9.2 per cent recorded in December 2016.

The auction for the first-quarter of 2017 also follows a similar one carried out by the Central Bank in November 2016.

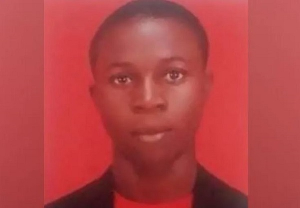

“We shall continue with our auctions that we talked about as part of our regular forex interventions, the $120million auction that you heard about. But some people take it that $120million is all we are going to use to be present in the market but that is just part of it. Our regular normal intervention to moderate volatilities of the forex markets will continue,” Bank of Ghana Governor Dr Abdul-Nashiru Issahaku told Class Business.

“You recall we talked about the Cocoa Syndicated proceeds that come through and how we channelled it through the bank in transparent fashion to the market to the commercial bank; that’s what it is. The auctioning is that transparent process that we are utilising to channel the monies to the markets.”

Click to view details

Business News of Thursday, 26 January 2017

Source: classfmonline.com